How to Spot Real Estate Investment Opportunities in Dubai

Dubai’s real estate market, characterized by its robust economic performance and strategic location, stands as a prime choice for global investors. Renowned for its architectural marvels and luxury lifestyle, the city not only promises high returns but also offers a stable investment environment. This guide aims to equip you with concrete, data-driven insights to navigate and capitalize on these opportunities effectively. We’ll explore the critical factors that savvy investors consider when evaluating properties in Dubai, ensuring you make informed and strategic investment decisions in this dynamic market.

Dubai’s Economic Overview

Current Economic Climate

Dubai’s economy is a robust mix of tourism, trade, and finance, insulated in part by its strategic location as a crossroads for Europe, Asia, and Africa. Despite fluctuations in global oil prices, Dubai’s GDP has shown remarkable resilience, supported by government initiatives aimed at diversifying revenue sources and boosting economic activity.

Predictions for Economic Growth

With major events like Expo 2020 and the continual expansion of sectors like fintech and green energy, Dubai’s economic outlook is promising. Experts predict steady growth driven by increasing foreign direct investment and ongoing infrastructural developments.

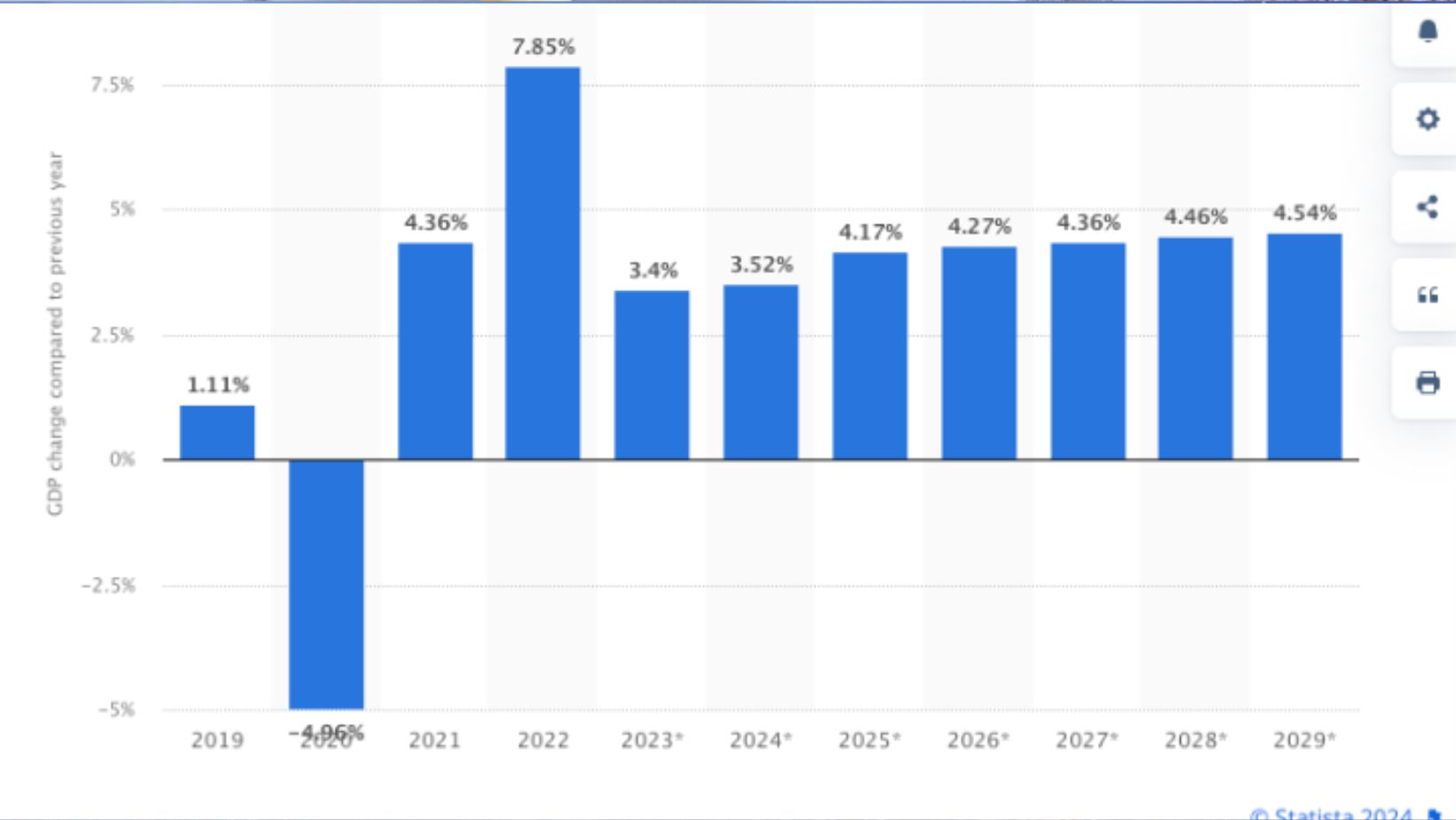

United Arab Emirates: Gross domestic product (GDP) growth from 2019 to 2029

Advantages of Investing in Dubai

Strategic Location Benefits

Dubai’s geographic positioning provides unmatched access to emerging markets. This global connectivity makes it a top choice for international businesses looking to establish a Middle Eastern foothold, directly benefiting real estate investors through heightened demand for both commercial and residential properties.

Stability and Growth Potential of the Real Estate Market

Dubai’s real estate market offers stability that is rarely found in other global cities. Property values have steadily appreciated, thanks in part to a continuous influx of expatriates and multinational companies setting up regional bases here.

“In the first quarter of 2024, Dubai’s residential property market has seen a notable increase in prices. By March 2024, the average property prices rose by 20.7% compared to the previous year, showing a slight uptick from the 20.3% growth noted in February 2024. Specifically, apartment prices grew by 20.4%, while villa prices saw a more substantial rise of 22.1%.”

Key Investment Opportunities

Residential Properties

The interest in residential properties across Dubai continues to rise. Neighborhoods such as Al Barari, Za’abeel, Dubai Marina, and Downtown Dubai are becoming increasingly popular, thanks to their high rental yields, drawing significant attention from investors. The allure is particularly strong for luxury and waterfront properties, which fetch top dollar in both sales and rentals.

|

Neighborhood |

Average Rental Yield (%) |

|

Al Barari |

8.30 |

|

Za’abeel |

7.28 |

|

Dubai Marina |

6.54 |

|

Dubai Hills Estate |

6.04 |

|

Jumeirah Golf Estates |

5.98 |

|

Jumeirah Beach Residence (JBR) |

5.82 |

|

Business Bay |

5.72 |

|

Downtown Dubai |

7.80 |

|

Palm Jumeirah Apartments |

5.34 |

|

City Walk |

5.24 |

Commercial Real Estate

The commercial sector, particularly in free zones like Dubai Internet City and Dubai Media City, is burgeoning.

These areas offer tax benefits and state-of-the-art facilities that attract international businesses, ensuring robust demand for office spaces.

Upcoming Areas for Investment

Districts such as Al Maktoum City and Dubai South are witnessing rapid development and offer the potential for high returns on investment due to their proximity to the new Al Maktoum International Airport and planned residential projects.

Factors to Consider Before Investing

Legal and Regulatory Framework

Understanding the UAE’s property laws, including those specific to foreign ownership and rental regulations, is crucial. Dubai has a well-established legal framework that protects investors and streamlines transactions.

Market Trends and Data Analysis

Investors should leverage data analytics to understand pricing trends, occupancy rates, and the historical performance of different neighborhoods. This quantitative approach can help identify under-valued opportunities that might yield high returns.

Step-by-Step Guide to Investing in Dubai

Identifying Potential Properties

Utilizing a combination of real estate platforms, professional agencies, and personal visits can help investors narrow down their options efficiently.

Conducting Due Diligence

A thorough due diligence process should include checking the developer’s credibility, the property’s legal status, and its physical condition through detailed inspections.

Understanding Financing Options

Exploring different financing options, comparing mortgage rates, and understanding the impact of these financial decisions on overall investment returns are key steps before finalizing a property purchase.

Risk Assessment and Management

Common Pitfalls in Dubai’s Real Estate Investments

Investors sometimes overlook the impact of location and market saturation, which can lead to poor returns. It’s also common to underestimate the total cost involved, including maintenance fees and property management expenses.

Strategies to Mitigate Risks

Diversifying investments across various property types and locations within Dubai can reduce risk.

Regular property evaluations and staying updated with market changes are also crucial.

Investing in Dubai’s real estate market offers substantial opportunities, but like any investment, it comes with its risks. Armed with the right knowledge, a clear strategy, and an understanding of the economic forces at play, investors can navigate Dubai’s real estate landscape successfully and profitably.

How to Modernize Your Spa Room at Home

How to Modernize Your Spa Room at Home  Tips for Designing Your Own Gaming Space

Tips for Designing Your Own Gaming Space  How to Make Oak Cabinets Look Modern: Stylish Updates and Design Tips

How to Make Oak Cabinets Look Modern: Stylish Updates and Design Tips